Replacing traditional meat and dairy products with alternative proteins is one of the best tools available to combat the climate crisis. Increasing the global market share of alternative proteins from 2% today to 8% by 2030 could yield an emissions reduction equivalent to decarbonizing 95% of the aviation industry. To build market share quickly, alternative protein companies must find ways to attract mainstream consumers.

Alternative dairy, the largest category of alternative proteins by retail sales, has done a lot to appeal to mainstream consumers—and US retail sales grew by 12% in 2022. Alternative meat, on the other hand, has had less success with mainstream consumers—and US retail sales declined by 0.4% in 2022. Further product innovation is necessary to bring alternative meat to parity with traditional meat, but our analysis found that companies also have significant room for improvement in their marketing of alternative meat products to mainstream US consumers.

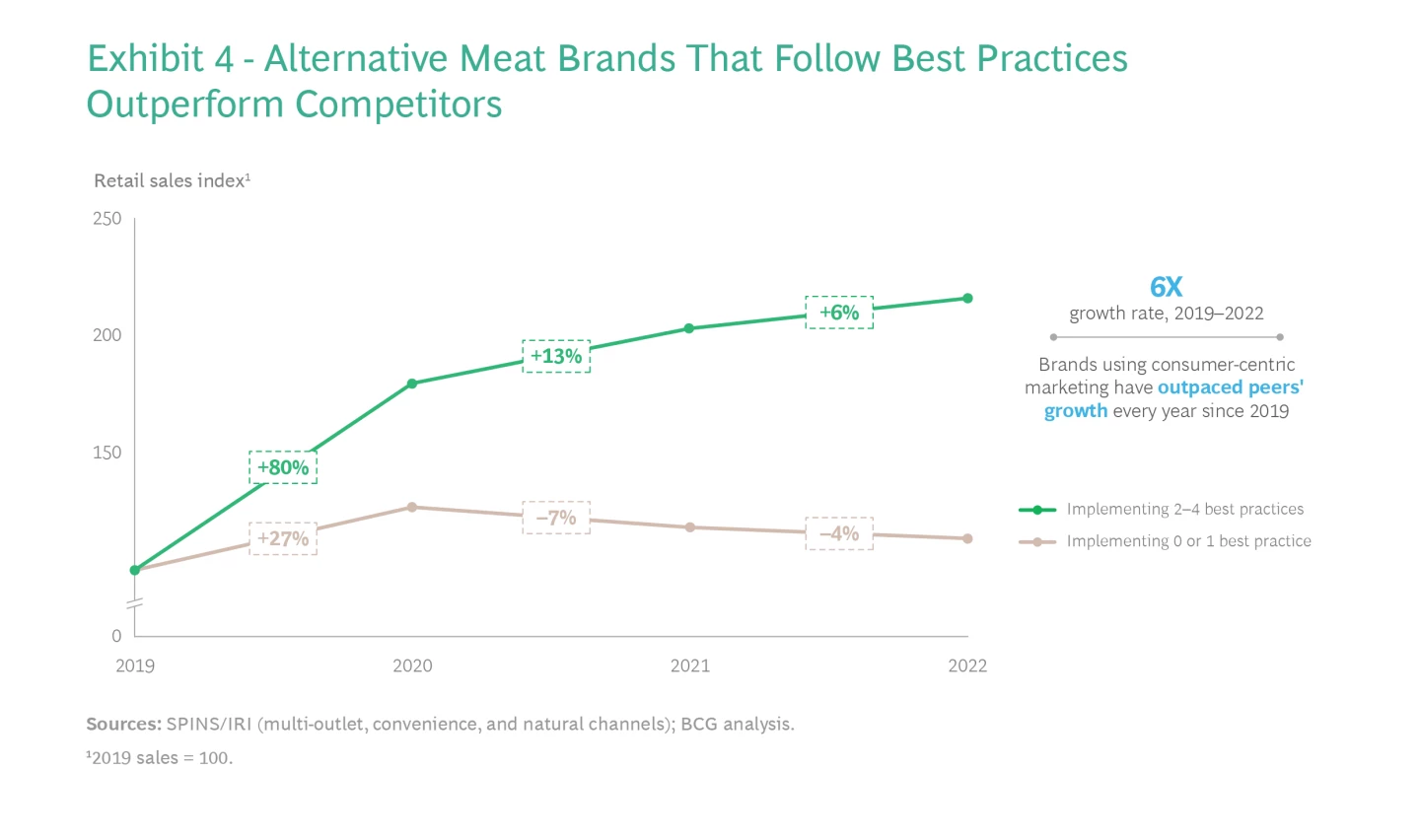

We have identified four immediate actions that companies can take to stimulate consumer demand for alternative proteins—particularly alternative meat—in the US. Alternative meat companies currently implementing two or more of these actions are outperforming their competitors by a wide margin (six to one). In addition, we point out several concrete steps that alternative protein companies can take to build market share over the long term.

For companies that produce and sell alternative proteins, 2022 was a year of concerning headlines, as the disappointing stock performance of former market darlings such as Beyond Meat and Oatly attracted considerable attention. Nevertheless, the overall trajectory for alternative proteins in the US, as indicated by 2022 retail performance, shows significant and continued growth. (See “Types of Alternative Proteins.”)

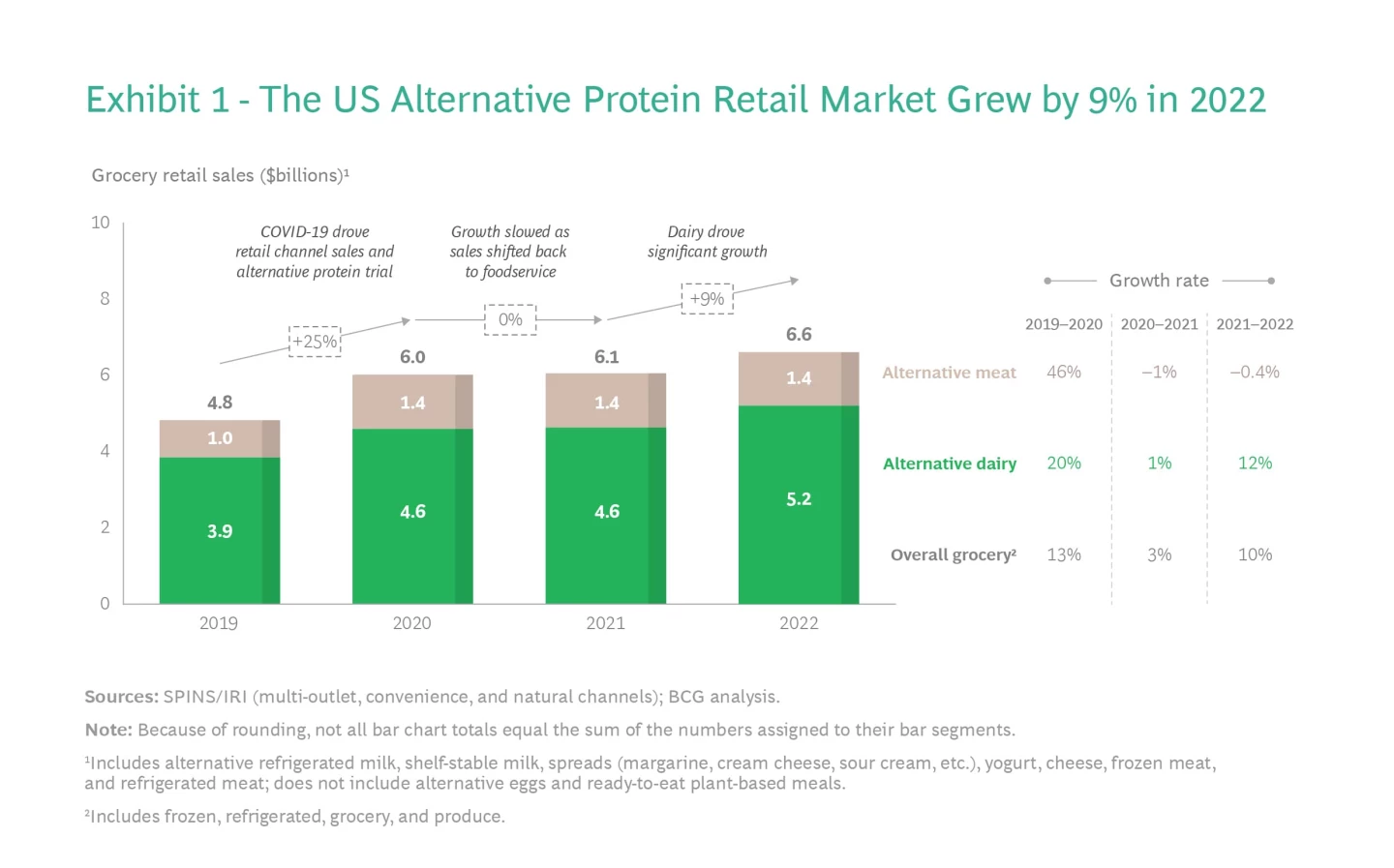

Across alternative dairy (which includes alternatives to milk and other dairy products such as cheese and yogurt) and alternative meat (which includes frozen and refrigerated alternatives to meats such as burgers and sausages), US retail sales grew by 9% in 2022.1 (See Exhibit 1.) Although growth in 2022 fell short of the explosive figures seen in 2019 and 2020 (which saw a 25% increase in retail sales), some degree of deceleration was to be expected; 2020 was an anomalous year, with retail sales inflated by the effects of COVID-19 and with brands like Impossible Foods just beginning to establish distribution.

Alternative dairy sales increased by 12% in 2022, growing faster than and gaining share over traditional dairy sales, which increased by 10%. Refrigerated plant-based milk, which accounts for nearly half of total alternative dairy sales, has consistently grown over the past three years and saw an 8% increase in sales in 2022.2 The smaller category of spreads (such as margarine and alternative cream cheese) increased by double digits after contracting in 2021. Alternative yogurt also continued to grow, while alternative cheese, a more niche category, contracted by 1%.

“According to research we conducted with Datassential, nearly half of all restaurants in the US offer plant-based options today, and four times as many operators plan to add plant-based meat to their menu as plan to drop it from the menu in 2023.”

—Rachel Dreskin, CEO, Plant Based Foods Association

In contrast to the largely positive picture for alternative dairy, alternative meat sales declined by 0.4% in 2022 (versus an increase of 8% for traditional meat). The decline was due to a 14% drop in volume of refrigerated alternative meat. On the other hand, frozen alternative meat, which initially carried a lower price premium relative to traditional meat than refrigerated alternative meat did, achieved a 6% gain in revenue when companies increased its price to compensate for a decrease in units sold. What’s more, alternative meats are becoming a fixture in fast-food restaurants around the world. (See “Trends in Foodservice.”)

Why is retail sales growth of alternative meat decelerating? One key driver is the inflationary environment of 2022. Faced with higher prices overall, consumers thought twice about paying the additional premium for alternative meat. In contrast, alternative dairy prices are competitive with traditional dairy prices in retail. Product-level concerns also remain top of mind for consumers, who see room for improvement in alternative meat on dimensions such as taste and texture. Achieving parity with traditional meat on these dimensions is a central task the industry must tackle to reach large-scale adoption.

What does this tell us about the future of alternative proteins? In our 2021 Food for Thought report, we wrote that 8% of all meat, seafood, eggs, and dairy eaten around the globe is likely to be alternative by 2030. We stand by that prediction. But alternative protein companies—particularly alternative meat companies—are missing out on significant opportunities to stimulate demand. Although innovation is needed to achieve parity in taste, texture, and price, the benefits that alternative meat products already provide today are not consistently landing with consumers. Companies can correct this mismatch by applying a more consumer-centric lens to marketing.

Animal agriculture, the largest greenhouse gas emitter within the food system, is responsible for 15% of global emissions. Alternative proteins are the most effective investment to achieve climate impact, offering the highest CO2e savings per dollar of invested capital of any industry—three times higher than the comparable return in the cement, transport, or aviation industry. This resonates with investors, as well as with consumer packaged goods companies looking to achieve decarbonization targets. As a result, many companies approach alternative proteins from the perspective of their positive impact on climate and sustainability. But consumer products are ultimately sold in a B2C context, so understanding what resonates with consumers is paramount in driving adoption.

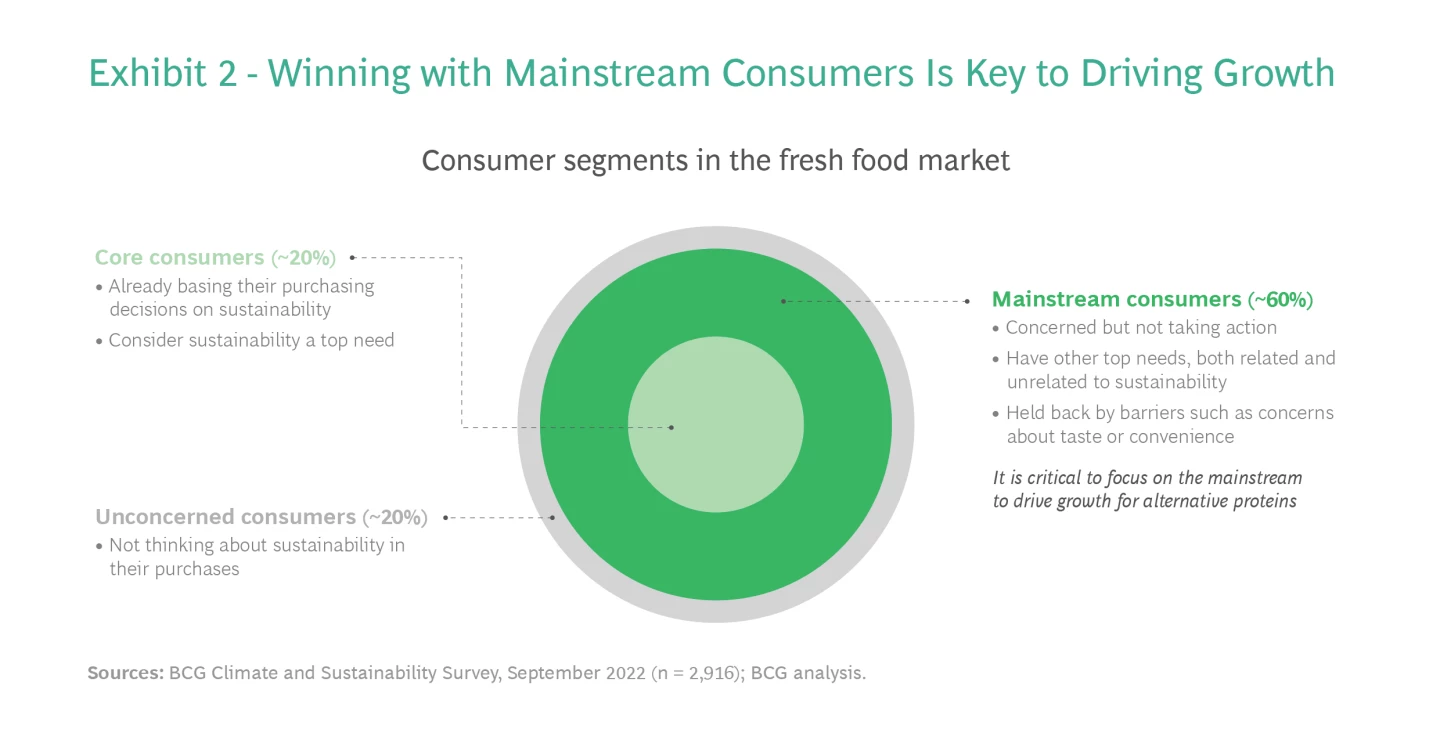

If alternative proteins are to gain traction quickly, companies cannot simply highlight sustainability. Across categories and geographies, we find a substantial “say-do gap”: although most consumers say that they care about sustainability, only a small minority act on it. When making decisions about food, only a core 20% of consumers base their purchasing decisions on sustainability. On the other hand, another 60% of consumers—the mainstream—are concerned about sustainability in the food supply chain but are not yet acting on it. (See Exhibit 2.) For these consumers, other needs influence food purchasing decisions.

In 2022, we surveyed over 2,900 consumers in the US, Brazil, the EU, India, China, and Japan and found that, when buying fresh food products such as meat and produce, they are most concerned about taste and health. In a sample of over 300 US consumers, BCG and Blue Horizon found that consumers’ top two criteria for purchasing alternative proteins are also taste and nutritional value (both ranked in the top three by 50% of respondents). These results suggest that mainstream consumers are unlikely to regularly buy alternative protein products for the sake of sustainability unless the products also meet the key needs of taste and health.

“Cows are the new coal. If cows alone were a country, they would be the world’s third highest emitter behind China and the US. We need to embrace alternatives to intensive animal agriculture if we want to meet our global climate and nature goals.”

—Jeremy Coller, President, Alternative Proteins Association

Concerningly, consumers’ association of alternative meat with taste and health has decreased since the start of 2021. Consumer sentiment analysis, leveraging social listening data from Instagram, shows that the association of alternative meat with taste-related keywords such as yummy and indulgent decreased by 5% year-over-year from 2021 to 2022. Similarly, consumers’ association of alternative meat with health, including terms such as healthy and unprocessed decreased by 3% year-over-year.3 At the same time, public discourse about alternative meat has become more critical, exacerbated by ads in prominent media outlets that describe products as highly processed.

“Across the industry, technological innovation to address the real barriers that consumers face in taste, texture, health, and price is a top priority. In the test kitchens of our portfolio companies, we are already seeing great strides compared to where we were two or three years ago: shorter ingredient labels; juicier textures; exciting combinations of plant-based, fermentation, and cell culture technologies.”

—Friederike Grosse-Holz, Director, Blue Horizon

In light of these findings, alternative protein companies must do more to connect their products to mainstream consumers’ needs. First, consumers want to see innovations that improve taste, texture, and price, where gaps relative to traditional meat remain. Second, brands need to remove perceived barriers (such as feeling that alternative meat products are difficult to cook with or are intended only for vegetarians) so that consumers will be able to recognize alternative meat products as the best choice to meet their unique needs. Companies can do this by tailoring their messaging to clearly connect existing products to consumers’ emotional and functional needs, rather than focusing primarily on sustainability.

To understand how to optimize communication with US consumers about alternative proteins, we analyzed more than 100 behavioral science research studies from the past decade, synthesizing the most relevant insights into consumers’ attitudes, behavior, and needs. The results suggest four actions that alternative protein brands should consider taking. (See Exhibit 3.)

Two are quick wins that may be relevant across the board and should be easy to implement quickly. The other two depend on the specific occasion that the brand is targeting. We focus on how these principles apply to front-of-pack messaging, where marketing real estate is especially limited, but these insights for targeting mainstream consumers apply across touch points.

“Alternative proteins are key to the much-needed food system transformation away from animal agriculture. And insights from behavioral science are critical for moving from theoretical debates to real-life changes in demand and supply.”

—Jens Tuider, International Director and Special Advisor to the President, ProVeg International

Quick win: Limit front-of-pack “vegan” and “vegetarian” labeling. Just 5% of US consumers consider themselves vegan or vegetarian.4 Adhering to a vegan diet is therefore not a top need of mainstream consumers, and labeling a product as vegan is unlikely to resonate with them. In fact, behavioral science research shows that prominently featuring a “vegan” label can create a psychological barrier for consumers. Consumers may think, “I am not vegan, so this product must not be for me,” and they are then unlikely to consider how the product might be able to meet needs they value more highly, like taste and health. Indeed, in a BCG consumer study on dining out, “vegan” ranked at the bottom of the list of claims that resonate with consumers.5 Similarly, a 2019 study by the Good Food Institute (GFI) and MindLab of US consumer preferences in a grocery retail setting found an association between vegan labeling of packaged goods and lower purchase intent by consumers.

In place of “vegan” or “vegetarian” labeling, we recommend using a phrase such as “does not contain animal products” to convey the same information without an identity-based label. Alternatively, using a phrase such as “suitable for a vegan diet” or including a subtle certification symbol on the back of the product can be informative for vegan or vegetarian consumers while not dissuading omnivores.

“Recently we’ve witnessed a backlash against processed foods. Consumers want to see and understand what they’re eating and are demanding cleaner label products. Our portfolio companies’ customers frequently ask, ‘What’s this made of?’”

—Tom Chapman, Head of Food Systems Impact, Sentient Ventures

Quick win: Identify the alternative protein source. As the narrative that alternative meat is processed or artificial has taken hold, consumers may increasingly feel unsure about what products are actually made of. Although the term plant-based scores relatively highly in consumer studies, some mainstream consumers may find it ambiguous. Research has shown that specifying the protein source of a plant-based product, such as potato or pea, is associated with higher overall ratings. Although consumers may view some protein sources more favorably than others, products that specify their protein source tend to outperform products that do not. In the same vein, showing images of familiar ingredients is associated with higher taste and health scores according to the 2019 GFI/MindLab study. Thus, while “plant-based” is a label that consumers like and are used to, adding information about the specific protein source may be helpful.

“Consumers like to know what they are eating, and—as an emerging category with various types of product formulations—this can be a challenge for alternative proteins. Specifying the protein source generates familiarity, which is of critical importance for consumers when it comes to food products.”

—Jessica Aschemann-Witzel, Professor and Center Director at MAPP—Centre for Research on Value Creation in the Food Sector, Aarhus University

Occasion-dependent practice: Highlight the product’s sensory appeal. In order for alternative meats to gain share, companies must effectively communicate to consumers that these products taste good. This is a tried-and-true practice for traditional meat products, which often highlight such taste-related attributes as “juicy,” “flame-grilled,” and “tender” on the front of their packaging. For plant-based food, emphasizing the sensory and emotional experience of consuming the product—by highlighting its taste and texture, for example—can increase the product’s appeal. Researchers have found that adding a label that appeals to a sense of indulgence (with wording such as rich, zesty, or slow-roasted) to the same plant-based dish increases choice by 25% compared to a basic informative label. On packaging, brands can combine this language with vivid, tempting visuals to increase taste associations and overall product appeal.

Because some consumers may assume that alternative meat products do not taste as good as meat, employing appealing descriptive language may be relevant across multiple occasions—if the product can deliver on its claims. Such wording is especially important when targeting occasions where indulgence and craveability are top consumer needs.

Occasion-dependent practice: Highlight health benefits. Along with taste, health is a top driver of choice for fresh foods. When marketing a product that has a desirable nutritional profile (such as being high in protein or low in saturated fat) and targets a health-led occasion, clearly emphasizing the product’s health benefits on the front of its packaging can resonate with consumers. In particular, going beyond providing nutritional information (“10 grams of protein”) to highlighting a benefit (“great source of protein”)—when accurate and consistent with FDA nutrition labeling guidelines—can increase the appeal of alternative meat and the willingness of consumers to eat it. This is especially true when the claims highlight a benefit (such as “high protein”) rather than a lack of an undesirable feature (such as “low calorie”), according to the GFI/MindLab research.

In some instances, highlighting taste and health attributes together may not work well. For example, on occasions where craveability is important, health is not a primary concern and may even trigger a negative reaction, given that some consumers may assume that healthier products will be less tasty. So while taste and health are both important, companies must gain an in-depth understanding of demand across occasions of use in order to effectively tailor their messaging.

Alternative dairy has reached relatively high penetration, at approximately 8% of the dairy category.6 And 88% of the top 25 alternative dairy brands already implement at least two of the four principles noted above on the front of their packaging. For example, the term “dairy-free” is commonly used instead of “vegan.” Most brands also refer to the protein source, like “almondmilk,” “coconutmilk yogurt,” or “plant butter with avocado oil.” Several brands emphasize health benefits such as calcium and omega-3 content, and several highlight sensory appeal through descriptors like “so rich and creamy” and “craveable flavor.”

In contrast to alternative dairy, only 56% of the top 25 alternative meat brands implement two or more of the four principles on their packaging. Most brands (68%) limit “vegan” language and instead use terms such as “contains no animal products,” but fewer than half implement the other principles. Specifically, only 40% highlight health benefits, which tend to focus on high protein content; only 40% identify the protein source; and just 28% highlight the product’s sensory appeal.

These rates of implementation tell us that alternative meat brands can make several near-term changes to help their products better resonate with consumers. Indeed, the growth rate since 2019 of alternative meat brands that have implemented at least two of the four principles is six times that of their peers. (See Exhibit 4.)

To drive mainstream adoption of alternative protein products, companies should take four steps.

Understand the needs of mainstream consumers. Given how important winning over the mainstream is to driving growth, brands must understand who their mainstream consumers are and what they need in the target occasion of use—where they are, who they are with, and what they are doing when consuming the product, as well as what their emotional and functional needs are at that time. For example, consumers might be looking for delicious food for a celebratory family dinner but be much more focused on health and convenience for an on-the-go breakfast. A nuanced understanding of consumers’ needs in the target occasion is essential. Using a “demand-centric growth” approach, companies can segment the addressable market on the basis of demand drivers and identify pockets of consumers with common emotional and functional needs.

“Given that taste and price determine what most people eat, it’s critical that we make alternative proteins as delicious, affordable, and accessible as conventional meat. By changing how meat is made, we can seize the opportunity to produce food that people love and usher in a more sustainable, secure, and just food future”

—Caroline Bushnell, VP Corporate Engagement, Good Food Institute

Innovate to improve taste, texture, and price. Innovation is critical to drive the industry forward. In recent years, companies have significantly improved the taste, texture, and price of alternative meat, but many consumers believe that there is still a gap between it and traditional meat. Beyond closing this gap and reaching parity, alternative protein companies should aim to surpass traditional products in meeting consumers’ core needs. To this end, brands must continue to innovate and test new products to learn what resonates best with mainstream consumers.

Tailor messaging to the mainstream. To effectively reach mainstream consumers, companies must broaden the dialogue beyond sustainability to focus on the needs that drive mainstream consumers’ choices. That entails implementing the marketing practices described earlier: limiting “vegan” language, identifying the protein source, highlighting the product’s sensory appeal, and highlighting health benefits. In addition, brands should ensure that their messaging speaks to other needs identified for the target occasion, such as convenience and quality, when the product can deliver.

Rigorously test and learn. Companies should adopt an iterative, test-and-learn mindset. Consumers are notoriously bad at predicting how they will behave toward sustainable products when asked, so it is important to perform tests that prioritize real-world behavior. Testing products with different packaging inside a simulated store or conducting an A/B pilot in an actual market may yield insights that simply asking consumers would not. Such an approach may lead to a deeper understanding of which kinds of messages can drive behavior change and promote the adoption of alternative protein products. Companies should also take a test-and-learn approach to their innovation process, refining both their products and their messaging over time. In 2022, for example, Impossible Foods improved the nutritional profile of its ground beef and updated its packaging to reflect these improvements.

Irrefutable evidence indicates that a shift to alternative proteins is critical to reducing emissions, and a consumer-centric approach is essential to driving market share growth in this area. Although there is opportunity to further drive adoption, especially in emerging categories, alternative dairy has proven that going mainstream is possible and that outpacing the traditional protein sector’s growth is achievable. Brands have an exciting opportunity to lean into consumer centricity to accelerate the adoption of alternative proteins.

The authors would like to thank the following BCG colleagues for their contributions to the development of this article: Lea Turquier, Adrien Portafaix, Louise Berrebi, James Gott, and Grant Anhorn. They also thank Jessica Aschemann-Witzel, Caroline Bushnell, Tom Chapman, Jeremy Coller, Rachel Dreskin, Maisie Ganzler, Friederike Grosse-Holz, Aneke Schwager, and Jens Tuider for sharing valuable insights.